Some Known Details About Dubai Company Expert Services

Wiki Article

A Biased View of Dubai Company Expert Services

Table of ContentsNot known Details About Dubai Company Expert Services A Biased View of Dubai Company Expert ServicesGetting The Dubai Company Expert Services To WorkHow Dubai Company Expert Services can Save You Time, Stress, and Money.Dubai Company Expert Services Things To Know Before You BuyAll About Dubai Company Expert ServicesFascination About Dubai Company Expert Services

The earnings tax rate is 0-17%. The personal earnings tax obligation rate is additionally low as compared to various other countries. The individual revenue tax obligation price is 0-20%. Among the greatest benefits of signing up a firm in Singapore is that you are not called for to pay tax obligations on capital gains. Returns are likewise tax-free here.

It is very easy to commence business from Singapore to throughout the world.

The start-ups acknowledged with the Start-up India initiative are supplied ample benefits for beginning their very own company in India. Based on the Startup India Activity plan, the followings problems need to be fulfilled in order to be qualified as Startup: Being included or signed up in India approximately ten years from its date of unification.

The Dubai Company Expert Services Ideas

100 crore. The government of India has introduced a mobile app and a website for easy enrollment for startups. Anybody thinking about establishing up a startup can fill a on the internet site and upload certain documents. The entire procedure is entirely on-line. The government likewise provides lists of facilitators of licenses and hallmarks.The government will birth all facilitator fees as well as the startup will certainly bear just the statutory fees. They will certainly take pleasure in 80% A is set-up by government to give funds to the startups as equity capital. The federal government is additionally offering warranty to the lenders to urge financial institutions as well as other economic establishments for providing financial backing.

This will assist start-ups to bring in even more capitalists. After this plan, the startups will have a choice to choose in between the VCs, providing the liberty to select their financiers. In situation of exit A startup can shut its company within 90 days from the day of application of ending up The federal government has actually recommended to hold 2 startup feasts annually both across the country and globally to make it possible for the various stakeholders of a startup to satisfy.

Not known Details About Dubai Company Expert Services

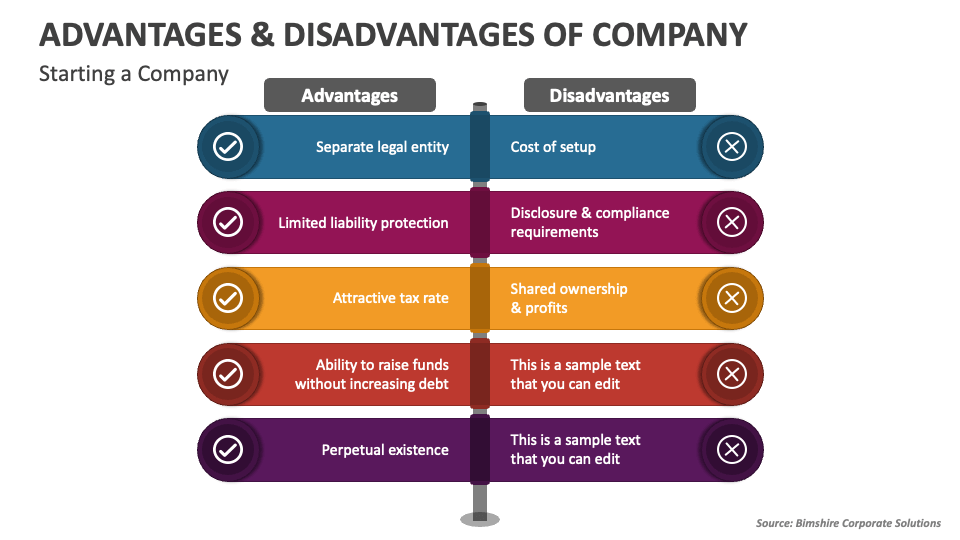

Limited business can be a wonderful choice for lots of home investors but they're wrong for every person. Some landlords may actually be far better off having property in their individual name. We'll cover the benefits and drawbacks of limited companies, to aid you determine if a minimal firm is the right alternative for your residential or commercial property investment organization.As a firm supervisor, you have the adaptability to pick what to do with the profits. You can invest in additional residential or commercial properties, conserve right into a tax-efficient pension plan or pay the revenue purposefully making use of rewards. This flexibility can assist with your individual tax obligation planning compared to directly owned homes. You can find out more concerning tax for property capitalists in our expert-authored overview, Intro to Residential Or Commercial Property Tax.

In which instance, Area 24 would affect your revenues. If your earnings are increasing, this is certainly something you ought to keep a close eye on and you could wish to take into consideration a minimal company. There are additional legal as well as financial duties to consider. As a supervisor of a firm, you'll lawfully be called for to maintain accurate business and financial records and send the proper accounts and returns to Companies Residence and also HMRC.

The Definitive Guide to Dubai Company Expert Services

That's precisely what we do right here at Provestor: we're a You'll require to spending plan around 1000 a year for a minimal business right here accounting professional and also see to it that the tax benefits of a limited firm outweigh this added price. Something that very few individuals discuss is dual taxes. In a limited firm, you pay firm tax on your earnings. Dubai Company Expert Services.It's worth discovering a specialist limited firm mortgage broker that can find the very best offer for you. Generally, there's rather a great deal to think about. There are plenty of benefits yet likewise extra costs and also even more complexity. Grind the numbers or conversation to a specialist to make certain that the tax financial savings outweigh the additional costs of a limited business.

An exclusive limited firm is a type of firm that has restricted obligation and also shares that are not easily transferable. The proprietors' or participants' properties are hence secured in case of organization failure. Still, it has to be stressed out, this defense only puts on their shareholdings - any cash owed by the useful reference organization stays.

Rumored Buzz on Dubai Company Expert Services

Nevertheless, one significant disadvantage for new businesses is that establishing an exclusive minimal company can be complicated as well as pricey. To safeguard themselves from obligation, business have to abide by specific formalities when integrating, consisting of declaring posts of organization with Business House within 14 days of incorporation and also the yearly verification statement.

The most common are Sole Investor, Partnership, and also Personal Restricted Firm. Minimal Responsibility The most substantial benefit of a personal restricted company is that the proprietors have actually limited liability - Dubai Company Expert Services.

If the business declares bankruptcy, the proprietors are only liable for the quantity they have purchased the firm. Any type of business's cash remains with the firm as well as does not fall on the proprietors' shoulders. This can be a substantial advantage for new businesses as it secures their assets from possible service failings.

What Does Dubai Company Expert Services Do?

Tax Effective Private minimal companies are tax effective as they can assert corporation tax relief on their revenues. This can be a substantial saving for businesses as well as boost earnings. On top of that, private limited companies can pay dividends to their shareholders, which are likewise strained at a lower rate. Furthermore, there are numerous other tax obligation advantages offered to companies, such as capital allocations as well as R&D tax debts.

This suggests that the firm can get with other services and also individuals and is accountable for its financial debts. The only money that can be declared directly in the firm's responsibilities and not those sustained by its owners on behalf of the business is shareholders.

This can be practical for tiny companies that do not have the moment or resources to take care of all the administrative jobs themselves. Flexible Management Framework Exclusive minimal firms are well-known for sole traders or local business that do not have the sources to set up a public limited company. This can be advantageous for companies who intend to maintain control of their procedures within a little group of people.

The 4-Minute Rule for Dubai Company Expert Services

This is because private minimal business are more reputable and well established than sole traders or partnerships. On top of that, private restricted see this website business usually have their site as well as letterhead, offering consumers and vendors a sense of rely on the business. Defense From Creditors As pointed out previously, one of the important advantages of a private minimal business is that it supplies security from lenders.If the company goes right into financial obligation or insolvency, creditors can not look for straight payment from the individual properties of the company's proprietors. This can be essential defense for the investors as well as supervisors as it limits their responsibility. This indicates that if the firm goes bankrupt, the proprietors are not directly responsible for any kind of money owed by the company.

Report this wiki page